What tariff rate will my Philippine product be charged with upon entry into Viet Nam?

Some Philippine products are imposed lower tariff rates by Viet Nam by virtue of the ASEAN Common Effective Preferential Tariffs (CEPT).

Click TARIFF for the specific rate imposed on your Philippine product upon arrival in Viet Nam.

It will help that you know the ASEAN Harmonized Tariff (AHTN) Nomenclature Code of your product, which you can verify with the Tariff Commission in the Philippines (www.tariffcommission.gov.ph) .

What Philippine products will be of interest to Viet Nam?

The Viet Nam economy has been growing at a dynamic pace in recent years, with an average annual growth rate of 7% from 2002-2007. Its top imports from the world in 2008 include machinery, equipment, tools and spare parts; petroleum; steel; fabrics; and electronics, computers and spare parts; plastics in primary form; automobiles; textiles and leather; chemicals, cattle feed and supplies; and fertilizers.

From the Philippines, it has been traditionally importing: copper, iron and steel, plastics, fetilizers, mineral fuels, sugar and sugar confectionery, paper, electrical machinery, and animal fodder.

Developments in Viet Nam also open opportunities for further possilbilities. In 2007, Viet Nam opened its economy to external trade when it became the 150th member of the World Trade Organization. The retail sector is expected to accommodate more players and consumer goods in 2009, especially given the rising purchasing power of Viet Nam's young population. Infrastructure construction is still expected to push through over the mid-term to address growing demands of the local and expat population.

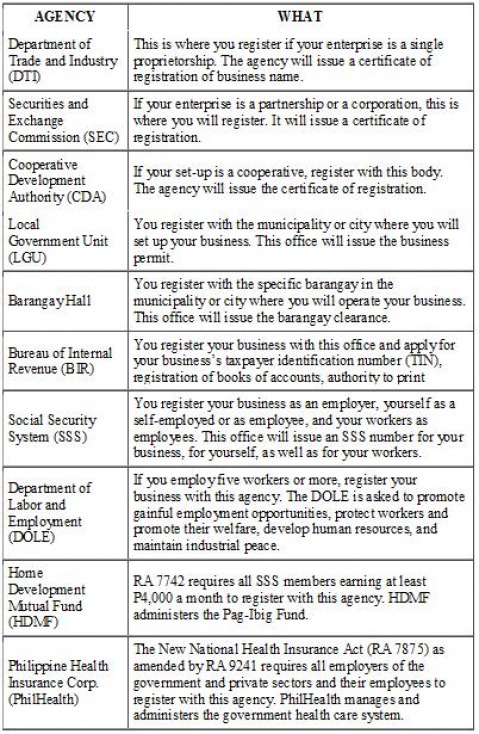

My family and I would like to start a business in the Philippines, while I am working as an expat in Viet Nam. Which agency/ies should we approach regarding registration procedures?

From: The PHILIPPINE BUSINESS REGISTRY (www.business.gov.ph)

Also, click this link for Business Name Registration in the Philippines,